The Continuing Evolution of the Secondaries Market

January 2025

What are Secondaries?

Traditional Secondaries

The answer to the question above used to be simple. A Traditional Secondary (also called an LP Fund Secondary) involves the sale of a limited partnership interest in an existing private fund from one investor to another, often with the involvement of a broker. The new investor takes the interest as-is. The fund sponsor’s involvement in the transaction is generally limited to accepting the buyer as a limited partner in the fund.

Non-Traditional Secondaries

Over the years, the secondary market expanded to include an entire spectrum of transactions, with fund sponsors becoming increasingly involved. Structurally, these Non-Traditional Secondaries are often very different from Traditional Secondaries. But, like Traditional Secondaries, they also provide investors with exposure to existing portfolios – often with additional structuring flexibility and other advantages. Different forms of Non-Traditional Secondaries are discussed below.

A GP-Led Secondary is a recapitalization of an existing fund that is facilitated by the fund’s own sponsor. These transactions are designed to provide liquidity options to existing fund investors by raising “replacement capital”. Like Traditional Secondaries, GP-Led Secondaries involve the new investor making money “on-the-buy”. Getting the entry price right is one of the key drivers of success.

GP-Led Secondaries commonly fall into two categories, each of which is described below:

- In a GP-Led Tender Offer, the buyer offers to acquire interests in a fund at a set price. Existing fund investors can then elect to cash out at the offered price or to continue to hold their interests. GP-Led Tender Offers differ from Traditional Secondaries in two key ways: First, the price is typically set by the buyer in cooperation with the fund sponsor rather than being negotiated between a buyer and a seller. Second, unlike in a Traditional Secondary, the fund sponsor often works directly with a broker to provide additional information about the fund, its assets, and the business plan going forward.

- GP-Led Continuation Funds also involve the recapitalization of a fund or a portfolio of assets held by a fund, leaving the sponsor (general partner) in place. However, unlike a straight GP-Led Tender Offer, these transactions (i) typically involve term extensions, (ii) may include only some of a fund’s assets, (iii) often include other negotiated changes to the terms of the fund or other vehicle (such as control rights for the new investor), and (iv) may include some new capital. In GP-Led Continuation Funds, existing investors in the target fund are generally given an option to either redeem their interests at a set price or “roll” their interests into a longer-lived vehicle.

GP-Led Secondaries have become more common in recent years and now represent more than half of the broader secondaries market across multiple asset classes, according to some estimates.1

In Direct Secondaries, the purchaser acquires an interest in a joint venture or other investment structure outside of a fund. Like GP-Led Secondaries, these transactions are generally pursued in collaboration with the existing sponsor, providing the new investor with information and with the opportunity to negotiate structural changes or governance rights. Direct Secondaries are highly customizable and can also include growth capital to pursue new acquisitions or value-add initiatives. This method of execution provides a much broader opportunity set: There are hundreds of existing private real estate funds, but there are many thousands of joint ventures and other non-fund structures.

GP Capital Solutions2 are really hybrid transactions. Like other secondaries, they involve buying into a portfolio of existing assets – typically in a fund or an asset-rich operating company. Unlike other secondaries (which are designed to provide liquidity for exiting investors), the capital is generally used to fund growth and allow the sponsor to continue executing its strategy. And unlike other secondaries, GP Capital Solutions often involve some form of revenue or profit sharing, with the sponsor compensating the secondary investor for being a strategic investor or a catalyst for growth.

While a GP Capital Solution secondary still involves making money “on-the-buy” because of the existing portfolio, the growth element and the revenue/profit sharing provide other avenues to generate profit. It is not a zero-sum game. Instead, it can be a partnership that results in a win for the sponsor, for existing investors, and for the new secondary investor.

Townsend sees particular value in GP Capital Solutions focused on capitalizing and institutionalizing sponsors with emerging niche capabilities in sectors that have an operating component to the underlying real estate. These include cold storage, data centers, single family rentals / build-to-rent, niche logistics, and senior housing, among others.

Summary of Secondary Types

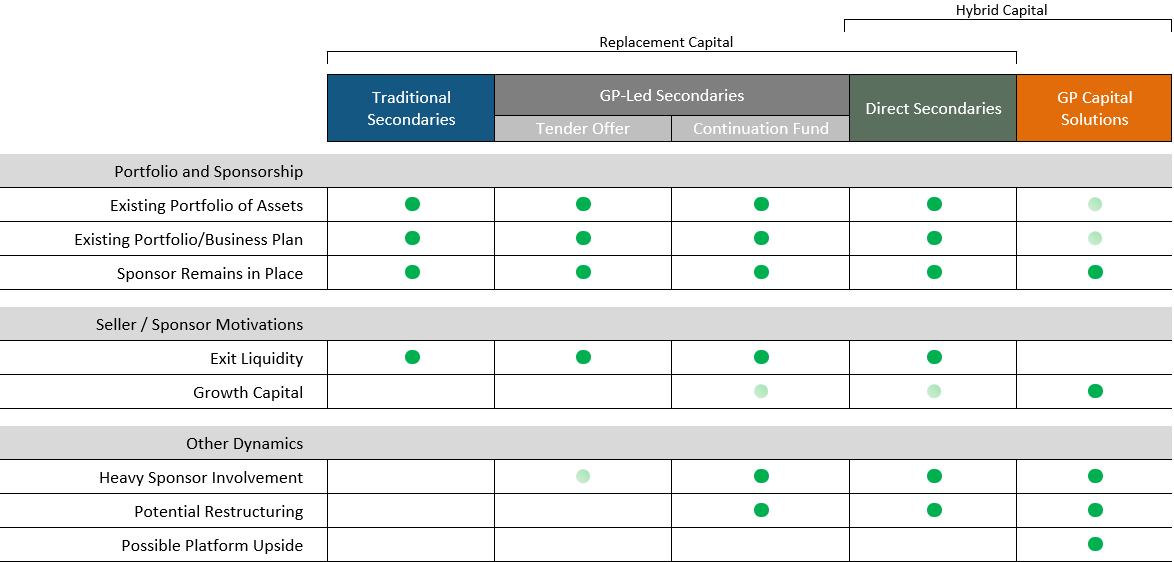

The table below summarizes the various forms of secondary transactions.

The Advantages of Secondaries

Advantages in General

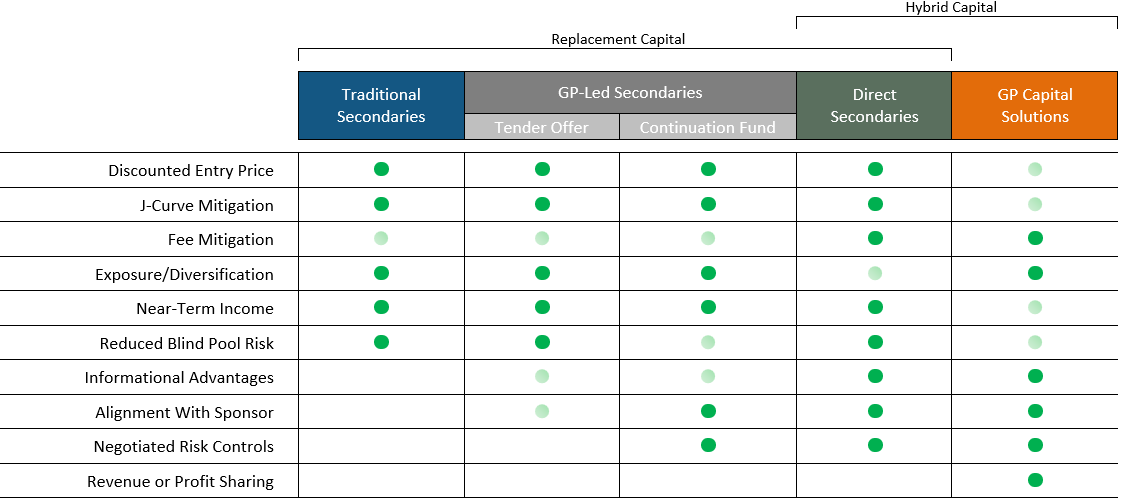

Many papers have been written about the advantages of Traditional Secondaries. These advantages, which are generally well-understood, are listed below.

| Discounted Entry Price | Exposure and Diversification | ||

| J-Curve Mitigation | Near-Term Income | ||

| Fee Mitigation | Reduced Blind Pool Risk |

When secondaries are executed well, these advantages combine to provide an asymmetric risk/return profile – allowing investors to generate a value-add or opportunistic return by taking core-plus risk. Leverage may also be lower than in a direct fund because debt amortization has occurred or because asset values have risen.

Additional Advantages of Non-Traditional Secondaries

Non-Traditional Secondaries provide additional benefits to investors:

| Informational Advantages | Investors in Non-Traditional Secondaries know exactly which assets they are buying. They can analyze those assets (along with the associated debt), assess values, and then offer to invest at a discount. |

| Alignment With Sponsor | Because Non-Traditional Secondaries are generally pursued in cooperation with fund/investment sponsors, new investors have access to detailed information from, and are generally aligned with, the group that knows the assets best. |

| Negotiated Risk Controls | Unlike investors in Traditional Secondaries, investors in Non-Traditional Secondaries have the ability to reshape an investment. A Non-Traditional Secondary investor can negotiate control rights to help protect its interests. If certain assets are a concern, it can negotiate to exclude those assets from the transaction. |

| Revenue or Profit Sharing | As discussed above, GP Capital Solutions can provide investors with opportunities to receive “GP Economics”, sharing in a sponsor’s revenues or profits. |

Summary of Benefits

The table below summarizes the benefits provided to new investors by the various forms of secondary transactions.

The Risks of Secondaries

Portfolio Risk

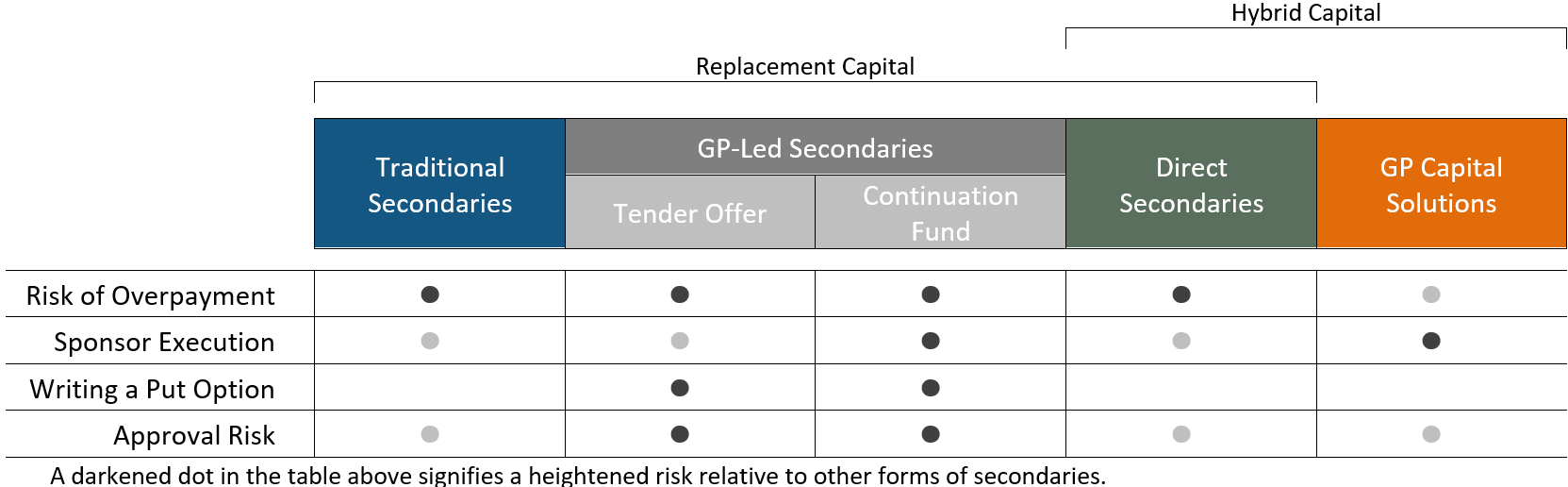

As noted earlier, one of the key benefits of secondaries is a discounted entry price. When a secondary is executed well, investors can generally make money “on the buy” and embed outperformance from day one.

Of course, the inverse is also true. Getting the initial valuation wrong can embed underperformance from day one. In our view, this is one of the key risks associated with secondaries.

Secondary transactions typically involve complex portfolios, complex capital structures, assets in various stages of their lifecycle, and opaque valuations. So, determining the correct valuation can be difficult.

Direct secondaries mitigate some of this risk. Joint ventures tend to hold smaller portfolios with fewer assets, allowing sponsors to provide more detailed information and allowing investors to underwrite portfolios more thoroughly.

GP Capital Solutions mitigate some valuation risk by providing growth capital for new investments. The trade-off is that investors are relying more heavily on the sponsor’s ability to execute.

Writing a Put Option

As discussed above, GP-Led Secondaries (“GLS”) offer many structural advantages to acquiring investors. However, they also contain a structural drawback: A GLS investor is providing a target fund’s prior investors with a put option. If the GLS investor overvalues the fund’s assets or underestimates the risk, informed fund investors will presumably take full advantage of the option to cash out. On the other hand, if the GLS investor undervalues the target fund’s assets too severely, fund investors won’t sell their interests and the GLS investor will be left with significant sunk costs of time, effort, and resources.

Because of this dynamic, the GLS investor needs to negotiate against itself a little – trying to set a price that is low, but not too low. It also needs to try to understand the liquidity needs and other motivations of investors, which should have a direct impact on the price that they will accept.

Approval Risk

LP Votes. GP-Led Transactions often require approvals from a target fund’s existing limited partners. Limited partners may vote against a proposed transaction because of the challenges that it presents. These challenges can include information asymmetry, resource asymmetry, misalignment, and an extended hold period.

GP Vetoes. In a Traditional Secondary, the sponsor of a fund typically must agree to accept the buyer as a new limited partner. In a GP-Led Secondary, the sponsor must work closely with the secondary investor. In both cases, the sponsor may decline to cooperate with certain buyers – particularly those that the sponsor views as a competitor.

RFRs. Traditional Secondaries can also be discouraged by a “right of first refusal”, which provides existing fund investors or sponsors an opportunity to intercept any opportunity that is negotiated by a secondary buyer. This risk can not only diminish deal flow, it can discourage secondary investors from considering secondaries in certain funds in the first place.

Summary of Risks

The table below summarizes the key risks across the various forms of secondary transactions.

The Market Opportunity

Real estate capital has become scarce. Much of the resulting pressure has fallen on real estate sponsors and investors. Open-end funds have virtually suspended redemption payments for two years. Closed-end funds are not liquidating as planned. And new capital is very difficult for many sponsors to raise.

We believe that this environment presents a significant opportunity for secondary investing. We also believe that the opportunity could become more durable – as real estate investors become more comfortable with the various forms of secondary transactions as part of their toolbox.

We discuss these views in greater detail in a companion piece titled “Why the Time is Right for Real Estate Secondaries”.

1Jefferies as of March 2023.

2Others use this term differently. In other contexts, it may include other forms of Non-Traditional Secondaries such as GP-Led Transaction.

Source: Townsend. Townsend’s views are as of the date of this publication and may be changed or modified at any time without notice. This document has been prepared solely for informational purposes and is not to be construed as investment advice or an offer or solicitation for the purchase or sale of any financial instrument. While reasonable care has been taken to ensure that the information contained herein is not untrue or misleading at the time of preparation, neither Townsend nor any of its affiliates have made any representation or warranty, express or implied, with respect to the fairness, correctness, accuracy, reasonableness or completeness of any of the information contained herein (including but not limited to information obtained from third parties unrelated to them), and they expressly disclaim any responsibility or liability therefore. Neither Townsend nor any of its affiliates have any responsibility to update any of the information provided in this summary document. The investments mentioned in this document may not be eligible for sale in some states or countries, nor suitable for all types of investors; their value and the income they produce may fluctuate and/or be adversely affected by exchange rates, interest rates, or other factors. There is no guarantee that Townsend will have access to similar types of investments or opportunities in the future. There can be no assurance that the investment will achieve comparable results, that underwritten returns, diversification, or asset allocations will be met or that the investment will be able to implement its investment strategy and investment approach or achieve its investment objective. Investing involves risk, including possible loss of principal. Past performance is not indicative of future results. Actual results and developments may differ materially from those expressed or implied herein.