Why The Time is Right for Real Estate Secondaries

January 2025

SUMMARY:

- Today’s market is capital-constrained, but the resulting pressure is distributed unevenly.

- The general partners as sponsors and limited partners have borne the brunt of this stress in the markets.

- Near term, investors seeking compelling distress-driven opportunities for new capital investment should prioritize accessing the secondaries markets.

- Long term, we believe that the secondaries sector will grow from acceptance as an episodically compelling tactical investment theme to become a structural part of real estate investors’ portfolios as it has already done in private equity.

FINDING THE STRESS

For two years, investors have heard about investment opportunities that will be driven by a “wall of maturities”, with over half a trillion dollars of US real estate debt coming due each year in a market with higher interest rates, lower asset values, tighter lending standards, low transaction volume, and low liquidity. The theory is that refinancing pressures will create investment opportunity for those who can provide liquidity.

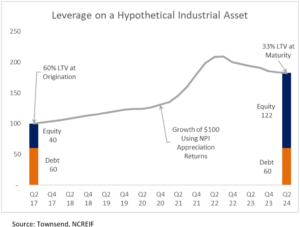

At the margin, this theory is playing out. But deal flow for traditional opportunistic strategies has been slower than expected. Bank balance sheets seem to be in relatively good shape. And owners of good assets in good sectors tend to have large equity cushions when their loans approach maturity. Even if asset values have declined in recent years, those values are often still much higher than they were five, seven, or ten years ago – when now-maturing loans were originated. These equity cushions lessen the pressure on both lenders and borrowers as they refinance assets or find other solutions. As a result, deal flow for traditional opportunistic strategies (buying assets from lenders, buying loans from lenders, or recapitalizing borrowers) is limited – at least when it comes to good assets in good sectors.

At the margin, this theory is playing out. But deal flow for traditional opportunistic strategies has been slower than expected. Bank balance sheets seem to be in relatively good shape. And owners of good assets in good sectors tend to have large equity cushions when their loans approach maturity. Even if asset values have declined in recent years, those values are often still much higher than they were five, seven, or ten years ago – when now-maturing loans were originated. These equity cushions lessen the pressure on both lenders and borrowers as they refinance assets or find other solutions. As a result, deal flow for traditional opportunistic strategies (buying assets from lenders, buying loans from lenders, or recapitalizing borrowers) is limited – at least when it comes to good assets in good sectors.

We believe that the market today offers a different access point: Much of the market stress has fallen on sponsors (general partners) and limited partners who are both under pressure from lower transaction volumes and low liquidity. Open-end funds have virtually suspended redemption payments for two years. Closed-end funds are not liquidating as planned. And new capital is very difficult for many sponsors to raise. These problems impact many good sponsors with good portfolios in good sectors. As a result, we believe that secondary transactions are a key tool for unlocking opportunity in today’s market.

THE SECONDARY TOOLBOX

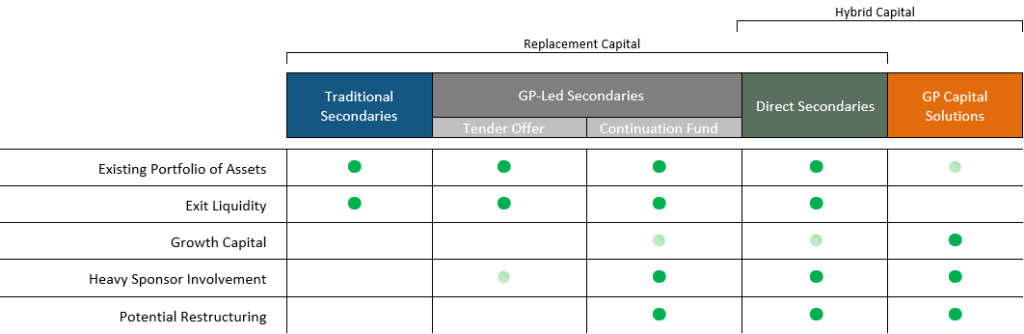

A Traditional Secondary involves the sale of a limited partnership interest in an existing private fund from one investor to another. The new investor simply steps into the shoes of the selling investor. Over the years, the market has evolved to also include a wide range of Non-Traditional Secondaries, which are typically structured as fund recapitalizations.

A companion piece published by Townsend, called “The Evolution of the Secondaries Market”, surveys the market and describes the various forms of secondary transactions in more detail. A list of our definitions also appears at the end of the paper.

THE PRESSURE ON SPONSORS

Real estate sponsors are facing three inter-related pressures:

Challenge 1: Slow Fundraising

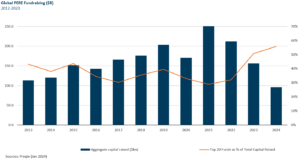

Fundraising in recent years has been very challenging for sponsors as a group. According to Townsend’s most recent Fundraising Report, closed-end funds that were launched in 2022 raised about 60% of what they were seeking, down from over 80% in 2018. Sponsors of open-end funds have been largely unable to raise new capital for the past two years.

Challenge 2: Uneven Fundraising

The challenge of slow fundraising has been compounded (at least for most sponsors) by a “flight to size”. Many investors have favored larger, brand-name funds that provide a degree of comfort in an uncertain market. In recent years, over half of the capital raised for private real estate funds has been captured by the 20 largest sponsors1. This leaves many excellent managers with insufficient capital to pursue their strategies.

Challenge 3: Limited Exits

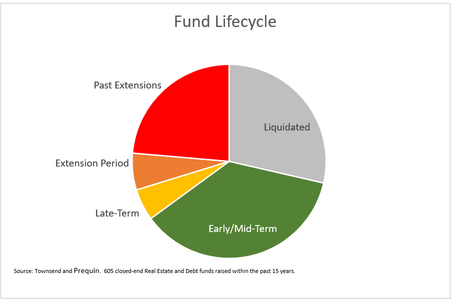

Rising interest rates and uncertain asset values have combined to slow the pace of transactions. This makes exits more challenging for fund sponsors, causing funds to drag on past their expected terms. As shown in the accompanying graph, about a third of the closed-end real estate and debt funds raised in the past 15 years are late in a normal term (roughly eight to ten years into their lives), are in a typical extension period (ten or eleven years) or are past a normal extension period.

The three challenges interact: If a sponsor is unable to return capital to its existing investors, it is less likely to raise capital in the future from those same investors or from outside investors (who are generally well-aware of a sponsor’s inability to provide liquidity). The pressure on sponsors to both raise and return capital can be enormous.

The three challenges interact: If a sponsor is unable to return capital to its existing investors, it is less likely to raise capital in the future from those same investors or from outside investors (who are generally well-aware of a sponsor’s inability to provide liquidity). The pressure on sponsors to both raise and return capital can be enormous.

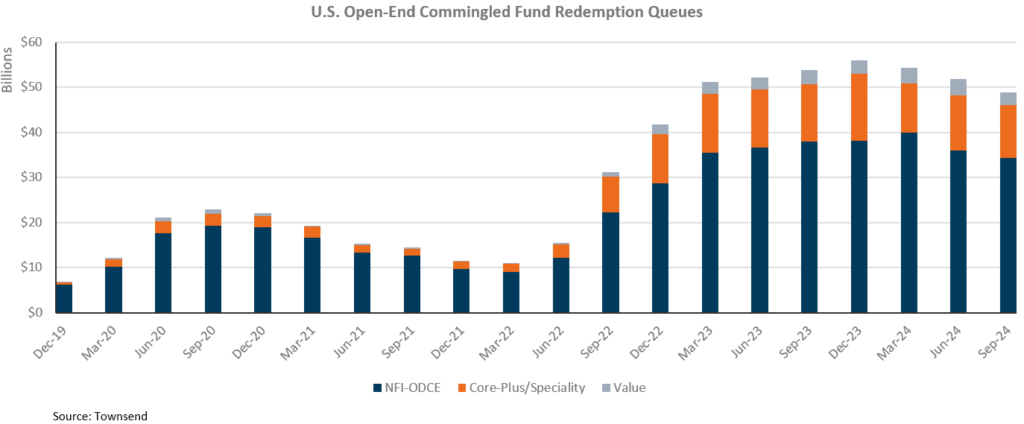

THE PRESSURE ON LIMITED PARTNERS AND OTHER INVESTORS

Limited partners are also facing challenges. While the “denominator effect” has been diminishing due to rising asset values across many asset classes, limited partners have had very limited access to liquidity within their real estate programs. Over the past two years, the open-end funds in the United States – a primary source of liquidity for many private real estate portfolios – have effectively been locked up as appraisers and fund sponsors try to find the right valuations. The aggregate “redemption queues” (lines to exit) for these funds currently stand over $40 billion. We believe that the true number is higher, with reported figures being artificially depressed by fund sponsors offering fee discounts to investors who stage their redemptions.

Open-end funds provide reliable liquidity in normal market times to facilitate investor needs for rebalancing and active portfolio management. However, in extreme periods of dislocation and price discovery when the markets themselves become illiquid, the mechanisms in these vehicles will not function as designed.

THE RESULTING OPPORTUNITY

Investor and Sponsor Reactions to Pressure

Investors needing liquidity in their real estate portfolios are more likely to sell through Traditional Secondaries and are more likely to support GP-Led Secondaries. Sponsors needing to provide liquidity are more likely to cooperate with a secondary investor in a GP-Led Secondary. Sponsors needing growth capital are more likely to work with a secondary investor on a GP Capital Solution.

On the ground, Townsend is witnessing robust activity across the spectrum of secondary transactions. Many advanced discussions are occurring across the industry involving sponsors, limited partners, and secondary investors.

Results

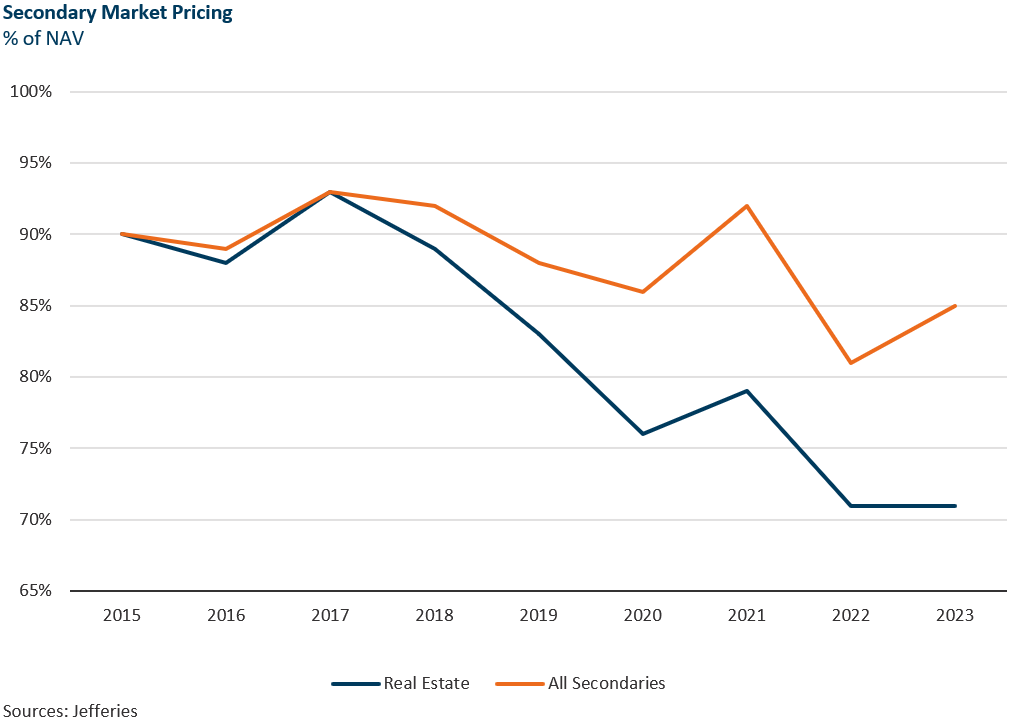

In our recent experience, secondaries have been available not only at large discounts reported values (as shown in the accompanying graph) but also at large discounts to market values.

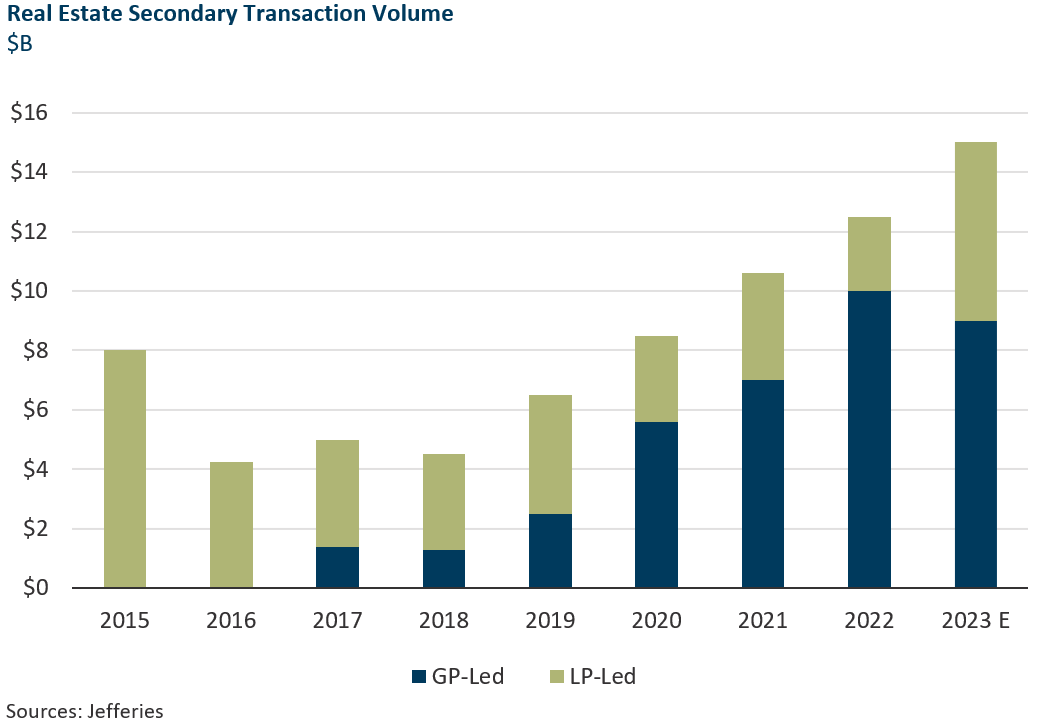

At the same time, transaction volume has grown dramatically over the last ten years, and particularly over the past few years. This represents a dramatic contrast to the property transaction market, which experienced a nearly 50% drop in volume since the peak in 2021.2

A Broader Universe: Direct Secondaries

Fund secondaries represent just the tip of the iceberg. While there are hundreds of active funds approaching or beyond the ends of their terms, there are likely thousands of additional partnerships, joint ventures, or other non-fund structures that own real estate portfolios. Many of those entities are experiencing the same liquidity pressures, capital gaps, and business plan interruptions that we have seen in funds over the last several years.

In addition, we have seen many motivated sellers in this space. When the market was strong, many traditional fund investors shifted capital toward joint ventures in an effort to obtain more control and become more involved. In today’s more challenging environment, some of them are finding that they are in over their heads and are looking for an exit. All of these dynamics help drive the opportunity for Direct Secondaries, providing a much larger opportunity set for secondary investors.

A Broader Universe: GP Capital Solutions

The same pressures that drive opportunity for other forms of secondaries also drive opportunity for GP Capital Solutions, broadening the opportunity set further.

In a GP Capital Solution, investors recapitalize existing portfolios and sponsors use the proceeds to fund growth rather than to provide exit liquidity. Rather than a “zero-sum game” like other types of secondaries, GP Capital Solutions can be a win for the new investor, a win for the sponsor, and a win for prior investors. Investors in GP Capital Solutions can position themselves as a strategic partner to sponsors in this uncertain time, and receive enhanced economics and better alignment, while still being grounded in favorable property exposures at re-set valuations.

The Future Role of Secondaries

The secondary market in real estate is still in its early stages. It is much less well-developed, and has emerged much more slowly, than the secondary market for private equity.

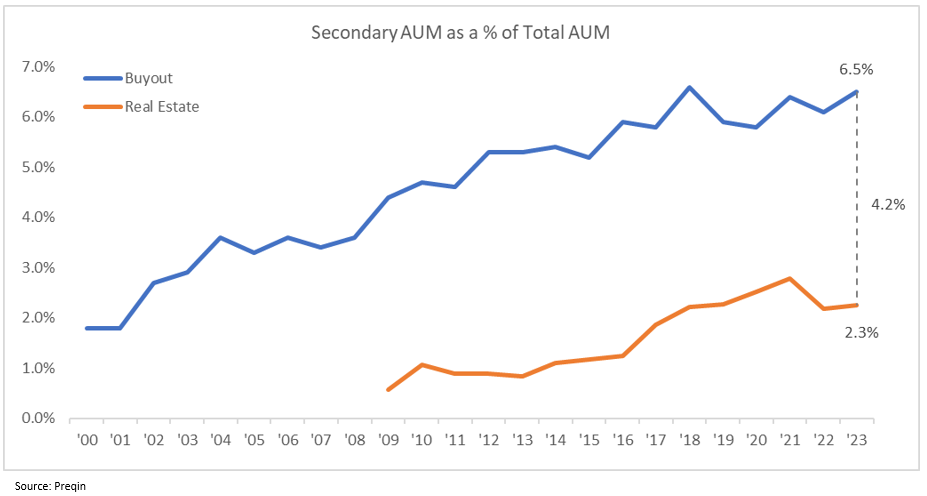

Secondary assets under management (“AUM”) for real estate are estimated to represent a little over 2% of total real estate AUM3. In contrast, secondary AUM for private equity buyouts is estimated to represent about 6.5% of total buyout AUM4. If real estate were to close half of that gap over time, secondary AUM would nearly double, growing the sector by around $36 billion.5

Secondary assets under management (“AUM”) for real estate are estimated to represent a little over 2% of total real estate AUM3. In contrast, secondary AUM for private equity buyouts is estimated to represent about 6.5% of total buyout AUM4. If real estate were to close half of that gap over time, secondary AUM would nearly double, growing the sector by around $36 billion.5

Real estate secondaries are also a small portion of the total secondaries market across asset classes, representing only 2% of total LP-Led Secondary transaction volume in 2023 and 3% of the total in the first half of 2024. Buyouts represented about 70% in both cases.6

The development of a secondary market in real estate may have been slowed by the presence of open-end funds and other potential liquidity sources. Without as much pressure to find liquidity (at least when markets are functioning smoothly), the industry did not develop a culture of active management like the one found in private equity.

That could be changing. The opportunity presented by the current market environment has created a lot of interest in secondaries. Once real estate investors have acclimated to the secondary market, they could be more likely to consider secondaries again in the future.

Secondaries could become a more permanent part of an allocation for real estate investors seeking a differentiated strategy that provides both structural benefits (such as a reduced j-curve and fee savings) and tactical opportunities.

Investors in real estate secondaries today may be able to capture an early-mover advantage in a sector that has actually been around for a long time. The early stage of acceptance for real estate secondaries might help explain why the discounts seen for real estate secondaries are much larger than the average for other asset classes (as shown in a prior graph).

EXECUTION

Successful execution in the secondaries space requires a combination of skills, relationships, and knowledge that relatively few organizations possess.

| Sourcing | – Knowledge of the private fund universe |

| – Understanding of limited partner needs and sentiments | |

| – Relationships with fund sponsors | |

| – Relationships with limited partners | |

| Evaluation | – A top-down view of markets and strategies |

| – The ability to underwrite complex real estate portfolios at the asset level | |

| – The ability to underwrite associated debt and joint-venture structures | |

| – Expertise in evaluating fund sponsors | |

| Structuring | – Expertise in analyzing and negotiating private fund structures |

Traditional advisory consultants possess many of the required attributes. They may have long-standing industry relationships, built over years or even decades of evaluating, investing with, and monitoring managers – often boosted by sitting on LPACs (limited partner advisory committees) or attending annual meetings. They should have expertise in underwriting investment strategies, fund terms, and manager skills. However, most of them lack the expertise and deep resources needed to underwrite a portfolio from the bottom-up.

Investment managers, on the other hand, generally possess asset underwriting expertise and deep resources, but lack many other necessary attributes. Many investment managers could also be viewed by sponsors as a potential competitor in other areas – making cooperation more difficult and less likely.

DEFINITIONS

Traditional Secondaries

The answer to the question above used to be simple. A Traditional Secondary (also called an LP Fund Secondary) involves the sale of a limited partnership interest in an existing private fund from one investor to another, often with the involvement of a broker. The new investor takes the interest as-is. The fund sponsor’s involvement in the transaction is generally limited to accepting the buyer as a limited partner in the fund.

Non-Traditional Secondaries

Over the years, the secondary market expanded to include an entire spectrum of transactions, with fund sponsors becoming increasingly involved. Structurally, these Non-Traditional Secondaries are often very different from Traditional Secondaries. But, like Traditional Secondaries, they also provide investors with exposure to existing portfolios – often with additional structuring flexibility and other advantages. Different forms of Non-Traditional Secondaries are discussed below.

A GP-Led Secondary is a recapitalization of an existing fund that is facilitated by the fund’s own sponsor. These transactions are designed to provide liquidity options to existing fund investors by raising “replacement capital”. Like Traditional Secondaries, GP-Led Secondaries involve the new investor making money “on-the-buy”. Getting the entry price right is one of the key drivers of success.

GP-Led Secondaries commonly fall into two categories, each of which is described below:

- In a GP-Led Tender Offer, the buyer offers to acquire interests in a fund at a set price. Existing fund investors can then elect to cash out at the offered price or to continue to hold their interests. GP-Led Tender Offers differ from Traditional Secondaries in two key ways: First, the price is typically set by the buyer in cooperation with the fund sponsor rather than being negotiated between a buyer and a seller. Second, unlike in a Traditional Secondary, the fund sponsor often works directly with a broker to provide additional information about the fund, its assets, and the business plan going forward.

- GP-Led Continuation Funds also involve the recapitalization of a fund or a portfolio of assets held by a fund, leaving the sponsor (general partner) in place. However, unlike a straight GP-Led Tender Offer, these transactions (i) typically involve term extensions, (ii) may include only some of a fund’s assets, (iii) often include other negotiated changes to the terms of the fund or other vehicle (such as control rights for the new investor), and (iv) may include some new capital. In GP-Led Continuation Funds, existing investors in the target fund are generally given an option to either redeem their interests at a set price or “roll” their interests into a longer-lived vehicle.

GP-Led Secondaries have become more common in recent years and now represent more than half of the broader secondaries market across multiple asset classes, according to some estimates.

In Direct Secondaries, the purchaser acquires an interest in a joint venture or other investment structure outside of a fund. Like GP-Led Secondaries, these transactions are generally pursued in collaboration with the existing sponsor, providing the new investor with information and with the opportunity to negotiate structural changes or governance rights. Direct Secondaries are highly customizable and can also include growth capital to pursue new acquisitions or value-add initiatives. This method of execution provides a much broader opportunity set: There are hundreds of existing private real estate funds, but there are many thousands of joint ventures and other non-fund structures.

GP Capital Solutions are really hybrid transactions. Like other secondaries, they involve buying into a portfolio of existing assets – typically in a fund or an asset-rich operating company. Unlike other secondaries (which are designed to provide liquidity for exiting investors), the capital is generally used to fund growth and allow the sponsor to continue executing its strategy. And unlike other secondaries, GP Capital Solutions often involve some form of revenue or profit sharing, with the sponsor compensating the secondary investor for being a strategic investor or a catalyst for growth.

While a GP Capital Solution secondary still involves making money “on-the-buy” because of the existing portfolio, the growth element and the revenue/profit sharing provide other avenues to generate profit. It is not a zero-sum game. Instead, it can be a partnership that results in a win for the sponsor, for existing investors, and for the new secondary investor.

Townsend sees particular value in GP Capital Solutions focused on capitalizing and institutionalizing sponsors with emerging niche capabilities in sectors that have an operating component to the underlying real estate. These include cold storage, data centers, single family rentals / build-to-rent, niche logistics, and senior housing, among others.

1 Preqin December 2023

2 Source: NCREIF

3 Source: Preqin

4 Source: Preqin

5 Source: Preqin, Townsend

6 Jefferies, July 2024

7 Jefferies as of March 2023.

8 Others use this term differently. In other contexts, it may include other forms of Non-Traditional Secondaries such as GP-Led Transaction.

Source: Townsend. Townsend’s views are as of the date of this publication and may be changed or modified at any time without notice. This document has been prepared solely for informational purposes and is not to be construed as investment advice or an offer or solicitation for the purchase or sale of any financial instrument. While reasonable care has been taken to ensure that the information contained herein is not untrue or misleading at the time of preparation, neither Townsend nor any of its affiliates have made any representation or warranty, express or implied, with respect to the fairness, correctness, accuracy, reasonableness or completeness of any of the information contained herein (including but not limited to information obtained from third parties unrelated to them), and they expressly disclaim any responsibility or liability therefore. Neither Townsend nor any of its affiliates have any responsibility to update any of the information provided in this summary document. The investments mentioned in this document may not be eligible for sale in some states or countries, nor suitable for all types of investors; their value and the income they produce may fluctuate and/or be adversely affected by exchange rates, interest rates, or other factors. There is no guarantee that Townsend will have access to similar types of investments or opportunities in the future. There can be no assurance that the investment will achieve comparable results, that underwritten returns, diversification, or asset allocations will be met or that the investment will be able to implement its investment strategy and investment approach or achieve its investment objective. Investing involves risk, including possible loss of principal. Past performance is not indicative of future results. Actual results and developments may differ materially from those expressed or implied herein.